Investment Management News & Resources

Objective information about retirement, financial planning and investments

Recipes for Connection: Tradition is the Ultimate Investment

November 19, 2024

The holidays are here — a time for warm meals, fond memories, and gathering with the people who matter most.…

Turn 529 Plan into Retirement Gold with New Law

September 17, 2024

Did you know that unused 529 plan funds can now fuel your retirement? Thanks to a new law, you can…

A Positive Outlook Beyond Interest Rate Concerns

April 23, 2024

Have you noticed the headlines recently? There seems to be quite the buzz surrounding the Federal Reserve and interest rates.…

Intrinsic Value vs. Market Value – What Do They Mean?

March 7, 2024

Financial concepts and investment strategies can be complex. Many find reviewing their portfolios and understanding the figures presented a challenge. The…

5 Retirement Myths You Shouldn’t Believe

January 16, 2024

Imagine a future where your days are not dictated by the alarm clock but by your desires to explore, unwind,…

5 Ways You Can Empower Your Financial Decision Making

January 2, 2024

Ever wonder if you’re really getting the best care out of your investment firm or financial advisor? You’re not alone.…

2023 Debt Ceiling Deal: The Changes and What They Mean for Us

June 7, 2023

President Biden recently signed the 2023 Debt Ceiling Deal. This significant legislation plays a crucial role in preventing the U.S.…

Introducing the Tactical Advantage ETF (FDAT)

June 7, 2023

We’re excited to introduce the Tactical Advantage ETF (FDAT) listed on the NYSE – a groundbreaking investment solution designed to…

Harvesting Returns: Investment Lessons from the Garden

May 30, 2023

The sun is shining, birds are chirping, and Spring is in full swing. It’s a season of new beginnings and…

The Dance of Low Standard Deviation: Waltzing with Market Stability

May 16, 2023

Understanding investment strategies is akin to mastering a variety of dances. Each has its rhythm, charm, and intricacies. Today, we’ll…

Charting the Course of Behavioral Finance

May 9, 2023

The human mind is a complex machine, capable of brilliance but often clouded by emotions and biases. In the world…

How 4 Generations Think Differently About Retirement

November 7, 2022

The COVID-19 pandemic upended Americans’ lives. In many cases, the pause on society affected retirement finances and plans. An October…

IRS to Make Largest Increase Ever to 401(k) Contribution Limit

October 26, 2022

Americans can save thousands more dollars in tax-advantaged retirement plans in 2023. Millions of Americans can save more in retirement…

Andy Friedmand Says SECURE 2.0 Should Pass After Midterms

October 14, 2022

Very few bills are likely to move in the lame duck session that historically grips Congress after mid-terms, but Washington…

What Is an Independent Financial Advisor?

August 19, 2022

An independent advisor is not tied to any specific family of funds or investment products. Many independent financial advisory firms…

When Will The Bear Market End?

June 7, 2022

A quote by the celebrated fund manager Sir John Templeton states, “Bull markets are born on pessimism, grow on skepticism,…

Annuity Essentials

May 10, 2022

In its most basic form, annuities are insurance that provides an income stream either for a fixed period of time…

Barron’s Top 100 List

March 8, 2022

One hundred years ago women couldn’t open a bank account, apply for a loan or become an accountant or lawyer.…

Gift Tax Limits: How Much Can You Gift?

February 8, 2022

For 2021, the annual gift tax exemption was $15,000 per recipient. In 2022, that number went up to $16,000. You can give…

5 Tips for a Financially Strong 2022

December 31, 2021

The start of a new year is a great time for introspection and evaluating the areas of your life you…

How Rising Interest Rates Impact Investments

December 10, 2021

In an attempt to control inflation, the Federal Reserve has signaled its intention to raise the federal funds rate (currently…

A Beginner’s Guide to Alternative Investments

June 30, 2021

Alternatives are investment options beyond the typical stocks, bonds and cash found in most portfolios. They can be tangible assets…

What Is Inflation—And Why Is Everyone Talking About It?

June 5, 2021

Climbing commodity prices, ambitious government spending packages due to the COVID-19 pandemic and the subsequent economic crash have resurrected a…

Financial Conversation Tips for Couples

May 25, 2021

Communication about money is often fraught for couples, and bringing the topic up with your partner can be challenging. But…

Breaking Down Socially Responsible Investing

May 5, 2021

Many investors want more out of their investments than just a good return. They want to know that the companies…

Preparing Teens for Financial Adulthood

April 25, 2021

Learning how to properly manage money is a crucial life skill that can take years to develop. For teen who…

Tips for Making the Most of Your Inheritance

April 5, 2021

Baby boomers in the U.S. are set to bequeath $68 trillion in wealth by 2043, as part of the Great…

Women and Wealth: Taking Charge of Your Finances

March 28, 2021

When it comes to financial planning, women are likely to face different challenges than men. For one, they earn less…

How Does Dollar-Cost Averaging Work?

March 1, 2021

When you’re in a traffic jam on the highway, you may find yourself trying to merge into whichever lane is…

Preparing for the 2021 Tax Season

February 25, 2021

How a financial advisor can help you manage your taxes this year Reducing your tax burden can help you manage…

Choosing the Right Life Insurance Policy

February 1, 2021

How to compare plans based on your specific needs The basic premise behind life insurance is simple: You pay premiums…

4 Smart Money Moves for 2021

January 29, 2021

With the new year in full swing, it’s a great time to take stock of your personal finances. From building…

Tax Tips for Charitable Donations

January 4, 2021

Charitable giving is a great way to support the causes you care about while also getting a tax break. In…

Creating a Successful Business Succession Plan

December 17, 2020

An exit strategy helps business owners ensure the long-term success of their company A good succession plan creates a blueprint…

Understanding Your Retirement Income Plan

December 1, 2020

Manage cash flow in retirement with multiple income streams When you retire, you get to bid farewell to the working…

How to Make a Wealth-Transfer Plan

November 17, 2020

A well-designed plan protects your wishes and helps avoid conflict among your heirs. A wealth transfer plan guides the movement…

The Importance of Long-Term Care Planning

November 2, 2020

Long-term care coverage can fill in the gaps other health care insurance leaves behind. Long-term care insurance helps cover the…

What You Need to Know About Investing During an Election

October 30, 2020

Elections can move the market, but that doesn’t mean you should change your approach Like any big news event, U.S.…

Preparing for Healthcare Costs in Retirement

October 1, 2020

For many Americans, navigating the maze of health insurance options—from employer-based plans to individual policies—can be dizzying. Much of that…

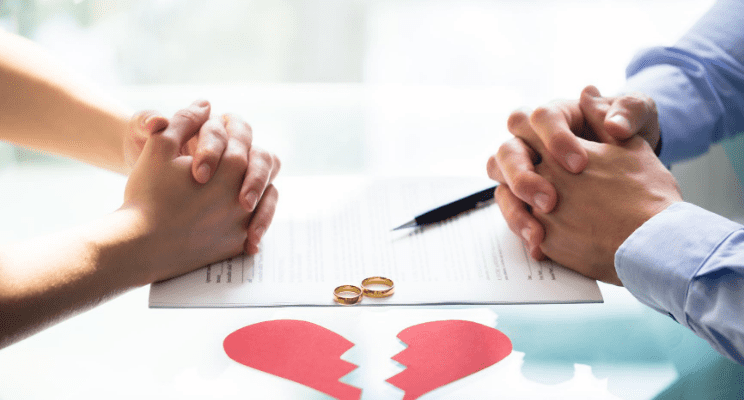

6 Steps to Protecting Your Wealth During Divorce

September 24, 2020

A divorce is one of the most difficult transitions you can go through. When you add uncertainty about money, that…

Understanding Retirement Income Tax

September 1, 2020

When you retire, you’ll likely draw your income from several sources—such as retirement accounts, taxable investment accounts, and Social Security…

5 Rules of Long-Term Investing

August 3, 2020

These best practices can help you stay invested during the market’s ups and down The COVID-19 pandemic helped put an…

Two Strategies for Rebalancing Your Portfolio

July 17, 2020

How to bring your portfolio back in line with your goals Your investment portfolio is more than the sum of…

Is Your Business Protected if Disaster Strikes?

July 1, 2020

A disaster plan can help your business survive a worst-case scenario. What would happen to your business after a fire,…

Understanding Behavioral Bias

June 29, 2020

Learning how emotions affect decisions can make you a better investor Are you a better-than-average driver? Chances are, you answered…

Your IRA and Your Legacy

June 1, 2020

Individual retirement accounts can play a valuable role in the estate planning process Individual retirement accounts (IRA) are a cornerstone…

Keeping Emotions at Bay During Virus Volatility

May 29, 2020

Fear, uncertainty, volatility, panic—these emotions are nothing new to the world of investing. In fact, they seem to reappear on…

5 Tips for Navigating the Coronavirus Crash

May 1, 2020

When stock markets experience sudden downturns, investors can feel anxious and make decisions detrimental to their long-term goals. After all,…

Leave a Lasting Legacy: Consider Your Impact on the World

March 30, 2020

Although there is a significant financial component to leaving a lasting legacy, it encompasses so much more than just money.…

What the SECURE Act Means for Your Retirement

February 28, 2020

On December 20th, 2019, the Setting Every Community Up for Retirement Enhancement (SECURE) Act became law. As the name implies, this law…