The sun is shining, birds are chirping, and Spring is in full swing. It's a season of new beginnings and blooming possibilities. Some members of our team are gardening enthusiasts. As we're in the investment world, we couldn't help but notice an uncanny resemblance between these two crafts.

Yes, you heard that right.

Flora and Finances. Somehow it just makes sense!

Let's dive straight into the heart of the matter. Think of each strategy as a different tool in your financial shed, each with its unique function and potential. We're not picking favorites here; just attempting to spread seeds of knowledge. Ready to dig in?

Income Investing

Tends to be conservative, focusing on steady income over time, usually from dividends or interest payments.

Buy and Hold

Typically conservative, involving long-term investment in stocks and waiting for them to grow over time.

Low Standard Deviation

Aims to reduce risk, a conservative goal, by investing in assets with smaller price swings.

Indexing / ETF strategy

While this strategy involves some level of risk (as it involves the whole market), it's not particularly aggressive. The majority of products out there aim to mirror a market index's performance, not beat it.

Now, let's pull out more tools from our gardening shed…

Value Investing

Involves a bit more risk, as it requires identifying undervalued assets that the market has overlooked.

Sector Rotation

This strategy takes on more risk by moving investments between sectors based on market trends.

Growth Investing

Involves higher risk as it requires investing in companies expected to grow at an above-average rate

Momentum Investing

Higher-risk strategy that involves following market trends and buying stocks that are going up, hoping they will continue to rise.

Swing Trading

Involves considerable risk as it requires profiting from short-term price patterns and market swings.

Tactical Asset Allocation

Often considered aggressive as it involves actively adjusting a portfolio based on short-term market forecasts, which involves a significant level of risk.

From Seed to Success: Harvesting Your Investment Potential

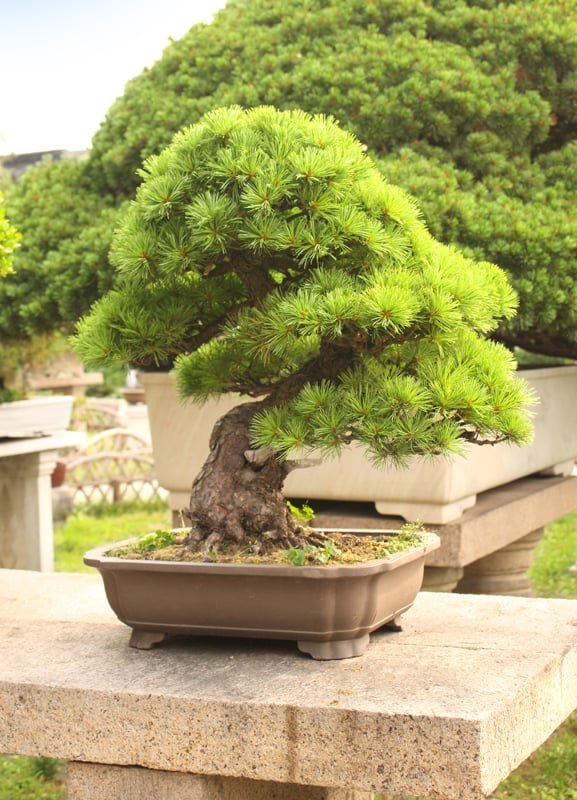

It's time to take the lessons learned from the bountiful world of gardening and apply them to your financial landscape. Remember, the tools you choose from your shed will shape your garden's growth and resilience. Whether it's the patient nurturing of the Bonsai Tree, the bold vibrancy of the Sunflowers, or the ever-evolving design of the Tactical Asset Allocation strategy, each decision you make will sow the seeds for your financial future.

But the most important lesson to take away is this: just as no two gardens are the same, there is no one-size-fits-all investment strategy. Find your unique financial flora and cultivate it with care and wisdom. Happy investing, and may your financial garden bloom with prosperity!