Your 60/40 Portfolio

just received an upgrade

Gain Access

To The Same Expert Strategies

We’ve Perfected For Our High-Net-Worth Clients

Adaptive Strategies for

Any Market

Broadly Diversified for

Reduced Risk

Tactical Adjustments for

Enhanced Returns

Sophisticated Strategies

for All Investors

Whether you're just starting out or have an established retirement account, you can benefit from capturing growth opportunities while mitigating risk.

Proactive Portfolio Management

Built to navigate market changes using sector rotation to shift underperforming investments to those with stronger growth potential.

Unlike passive strategies, the fund employs tactical adjustments and diversification to continuously adapt to shifting markets, minimizing risk while positioning investments to capitalize on emerging opportunities.

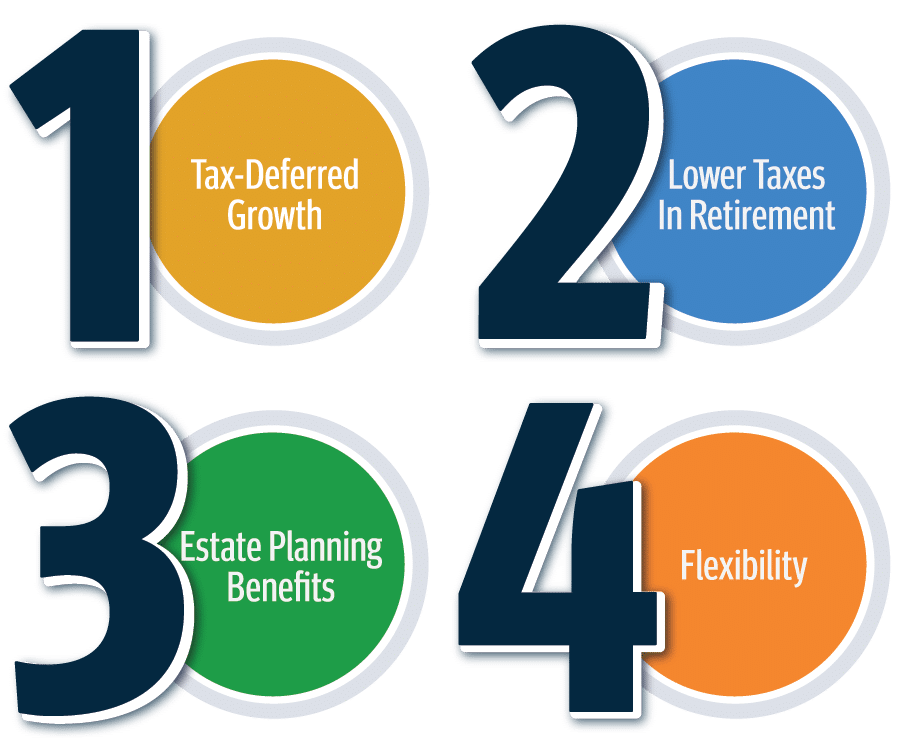

Growth Without Tax Headaches

Selling individual stocks and funds result in immediate capital gains taxes. In contrast, our ETF allows you to leverage a unique structure that permits rotating investments without incurring taxes until you fully withdraw from the ETF.

By deferring taxes until withdrawal, our ETF allows for more efficient growth, ensuring your wealth stays invested during key market movements for stronger long-term results.

Stay Calm Through Market Swings

Market fluctuations often push investors to act emotionally. Our ETF works in the background, adjusting to market changes and managing risk so you don't have to do the heavy lifting.

Isn't it time you experienced peace of mind? Our ETF is designed to keep your long-term objectives in focus, allowing you to invest with confidence and clarity.

Is It Time For An UPGRADE

Sticking to outdated strategies like a buy-and-hold 60/40 model can mean missing out on potential growth and exposing yourself to unnecessary risk.

Markets have changed, maybe it’s time your investments catch up?

Frequently Asked Questions

Learn More About

ExchangeTraded Funds