Understanding investment strategies is akin to mastering a variety of dances. Each has its rhythm, charm, and intricacies. Today, we'll glide into the world of Low Standard Deviation investments, which is a dance characterized by its steady, measured pace.

What is Low Standard Deviation?

Standard deviation, a term coined by statistician Karl Pearson, is a measure of how spread out numbers are in a data set. In the world of finance, it serves as a yardstick for the volatility of an investment's returns over time. High standard deviation suggests a dance filled with wild swings, much like the jitterbug, unpredictable and exhilarating. On the other hand, low standard deviation implies a smoother, more predictable waltz - a dance with more steady and predictable returns.

Low Standard Deviation investments, therefore, are more like the waltz than the jitterbug. They're characterized by a reduced likelihood of significant fluctuations in value, thereby offering stability amid the whirl of the market's grand ballroom.

Why Waltz with Low Standard Deviation?

The waltz of Low Standard Deviation investments, much like a seasoned dancer, offers a calming rhythm amidst the fevered jive of the stock market. If you're weary of the unpredictable twists and turns of the market dance floor, these investments may be your perfect dance partner.

Consistent Returns Over Time

Even though these investments might not always outshine in the short-term dance-off, they've been known to outperform their more frenetic counterparts over the long haul. According to a study by the CFA Institute, low volatility stocks often yield superior risk-adjusted returns over a full market cycle. It's this consistent rhythm that provides a reliable tempo for the marathon of long-term wealth building.

The Dance Partners in the Ballroom

Within the grand ballroom of the stock market, stocks, ETFs, and bonds waltz around, each dancing to their unique rhythm. Some are like jitterbug dancers, zipping around with high volatility. Others, like Low Standard Deviation investments, prefer the waltz, moving gracefully to a steady, predictable beat.

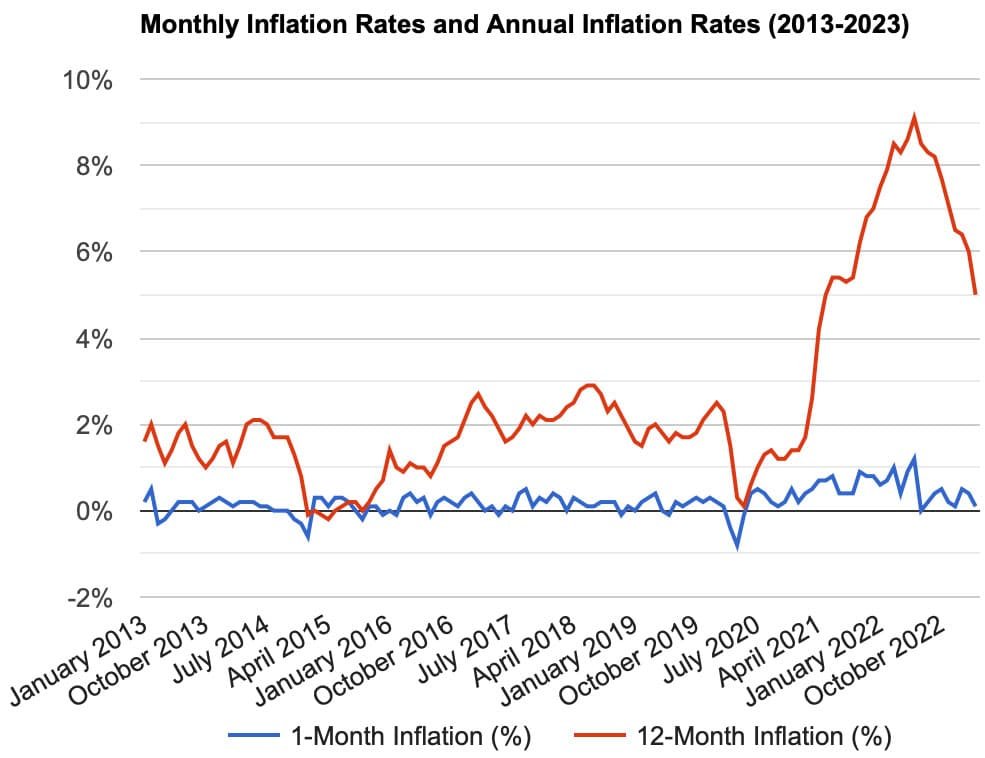

1-Month Data Sources: U.S. Bureau of Labor Statistics: All items in U.S. city average, all urban consumers, seasonally adjusted.

12-Month Data Sources: U.S. Bureau of Labor Statistics: All items in U.S. city average, all urban consumers, not seasonally adjusted.

Beware of the Misteps

No dance is without a misstep. Despite their charm, Low Standard Deviation investments may also have their pitfalls.

Underperformance

In a bullish market, these investments might seem like slow dancers. However, this steady rhythm should not be mistaken for weakness. As highlighted by the findings of renowned economist Robert Haugen, lower risk stocks can often outperform higher risk stocks, even in bull markets.

The Excitement Factor

Some might find these steady dancers unexciting, preferring the whirlwind of aggressive strategies. However, not everyone enjoys the limelight of a flamboyant flamenco. Some find beauty and excitement in the measured elegance of a waltz.

Fortune Telling

Standard deviation, much like a fortune teller, relies on the past to predict the future. But the future, like a dancer's next step, is unpredictable. So while a high standard deviation might signal a thrilling dance, it could lead to a soaring leap or a tumbling fall.

The Finale

Mastering how to use Low Standard Deviation investments takes time and practice, much like perfecting a dance. They offer a captivating strategy for those seeking to balance risk and reward. By understanding both the rhythm and the potential missteps, you can confidently navigate the financial dance floor.

In our next post, we'll delve deeper into making the most of these steady dancers. So, tie up your dancing shoes and stay tuned! We look forward to guiding you through the next dance.