Imagine a future where your days are not dictated by the alarm clock but by your desires to explore, unwind, and create lasting memories with loved ones. It's a dream many chase, but often get sidetracked by misconceptions about retirement planning.

For a fulfilling retirement, it's smart to start planning early. Be aware, though, there are many retirement myths that can mislead. Separating fact from fiction is key to a well-prepared plan, ensuring you enjoy your retirement just as you envision.

The Stock Market is Too Risky for Retirement Fund

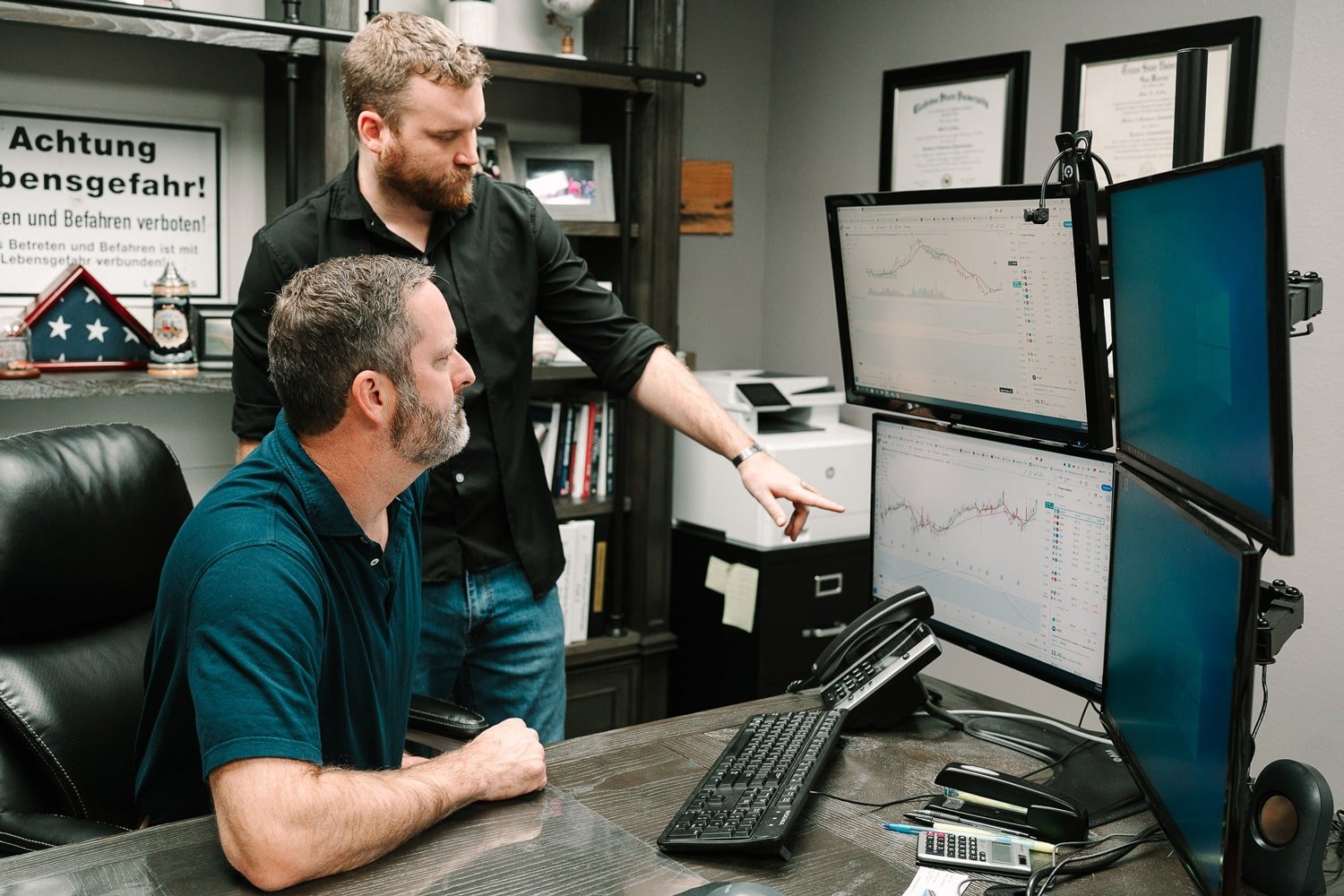

The idea that the stock market is too risky for your retirement savings is a common misconception. While investing in the stock market has its ups and downs, completely avoiding it could mean missing out on potential growth, especially for younger savers.

Yes, the market will fluctuate. There will be times when your investments, whether in a 401(k), IRA, or a simple brokerage account, grow and bring you joy. But there will also be downturns that can cause concern. The key is to remember the bigger picture: over the long term, the market tends to go up.

Feeling nervous during market lows is natural. This is where having a steady hand, like a financial advisor, can help. They can guide you through these fluctuations, ensuring your investment strategy aligns with your retirement goals.

Saving for Retirement Can Wait Until the 40s

There's a common notion suggesting that if you're in your 20s or 30s, retirement is too far off to start saving now. This idea couldn't be more misleading.

Early savings are crucial in building a robust retirement fund. The secret lies in compounding interest, a powerful financial concept where your savings earn interest, and that interest then earns more interest over time.

The beauty of this is that even a modest initial amount can grow significantly. By starting to save at 22 instead of 42, you're giving yourself an extra 20 years of compounding, significantly boosting your retirement wealth.

Remember, once those years pass, you can't regain that lost time and its compounding potential.

Social Security Can Fully Fund Your Retirement

It's a myth that Social Security alone will fund your entire retirement. Social Security is a significant help, offering payments based on your work history, but it's not enough by itself.

The highest amount you can get from Social Security is $4,555 per month, and that's if you wait until you're 70 to start collecting. While this money helps, it's probably not enough to cover all your retirement expenses, especially if healthcare costs pop up or you want a more comfortable lifestyle.

The smart approach? Mix Social Security with other savings and investments. This combination gives you a better safety net that can lead to a more secure and enjoyable retirement.

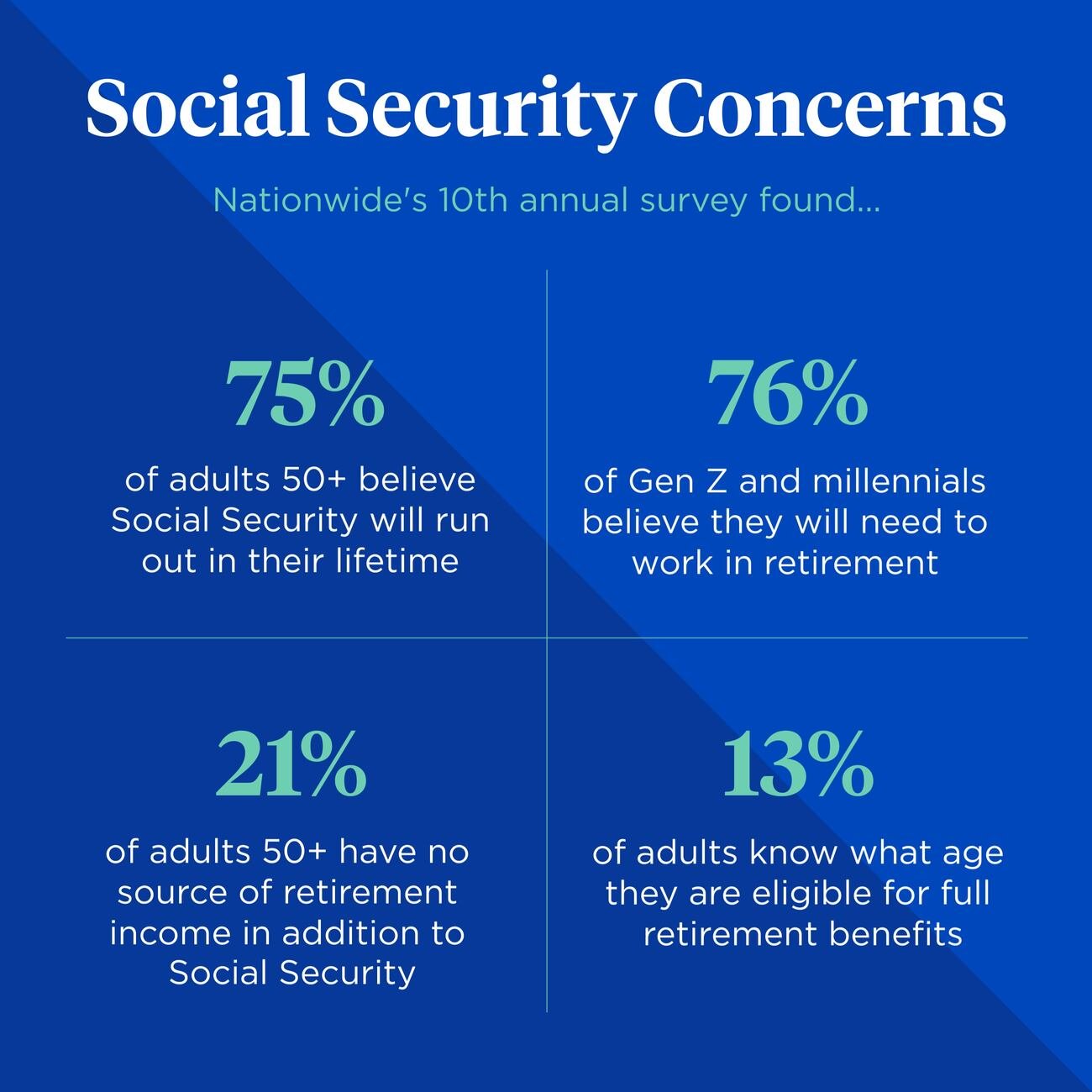

Nationwide Retirement Institute released its 10th annual Social Security survey, which revealed how Americans’ attitudes toward the program have shifted significantly over the past decade. The study found older Americans are increasingly concerned about its solvency in the near-term, with three-fourths (75%) of adults age 50+ saying they believe Social Security will run out of funding in their lifetime, up from 66% in 2014.(Nationwide)

Medicare Covers All Your Healthcare Costs for Free

Medicare, while invaluable for seniors, isn't the all-in-one solution for medical expenses in retirement. When you turn 65, enrolling in Medicare is just the start. You'll need to make key decisions, like whether to opt for Medicare Part D for prescription drugs.

Medicare contributes substantially to your healthcare needs, yet understanding its limitations ensures a more complete and secure retirement plan.

Assistance in Retirement Planning Isn't Necessary

Retirement planning might look simple on the surface, but it's actually a web of complex decisions and strategies. It's not just about putting money away; it involves intricately planning for future expenses, navigating tax laws, and balancing investment risks.

Some folks have the know-how and time to handle their retirement planning on their own.

But here's the thing: even if you can manage it independently, you might be missing out on key opportunities.

Working with a financial advisor can can be a game-changer. They bring more to the table than just investment advice; they offer a holistic view of your financial picture. Each advisor comes with their own set of skills and specialties, so finding one that clicks with your unique financial circumstances and needs can be crucial.

It’s about not just managing your retirement planning, but optimizing it to its full potential.

The Bottom Line on Retirement Planning

Figuring out retirement planning isn't always a walk in the park, even when you're armed with all the right info.

There's myths out there that can throw a wrench in your plans. But once you've got solid information, it's all about making smart moves: stashing away your cash early, making savvy investments, and reaching out for a bit of expert advice when you need it.

It's really about lining up your ducks now so that you're set for those dreamy retirement days ahead.