Have you noticed the headlines recently? There seems to be quite the buzz surrounding the Federal Reserve and interest rates. It might seem like these rate changes are the only thing that matters. But take a closer look, and you'll discover there's a strong backbone of economic growth that's often overshadowed by these stories.

Despite the usual worries about what the Fed will do next, the real story is about our economy's hidden strength and resilience—elements that shape our future potential.

Let's dive a bit deeper into what's really driving our economy's resilience.

Navigating Through Rate Hikes and Inflation: A Fresh Take

Interest rates and inflation alerts are enough to make anyone uneasy. But what if the economy is stronger than these headlines suggest? Some economists are peeling back the layers of shared perceptions and revealing a more robust economic picture. Despite what we often hear, including the cautious tones from Federal Reserve Chair Powell, the core elements of our economy—like employment and consumer spending—are holding up pretty well.

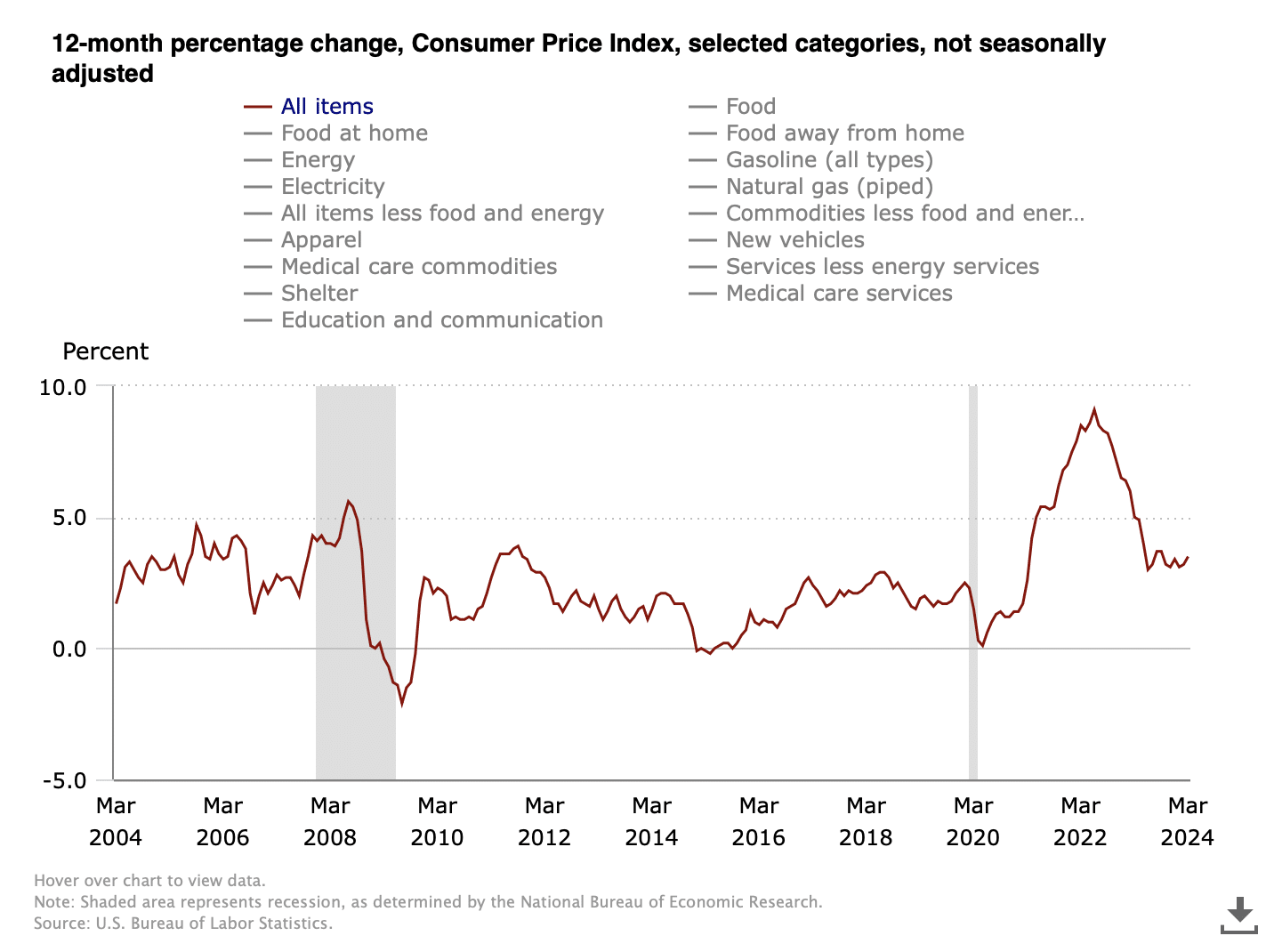

A Different Perspective on Inflation

Have you ever noticed how Inflation is like the weather? Sure, it changes, sometimes unexpectedly, and can undoubtedly impact your day—or your budget. While some see these fluctuations as ominous clouds over our financial security, they're part of a larger natural cycle within our economy.

During a recent chat on Fox Business, economist Don Luskin shared a refreshing viewpoint: "Inflation and the cost of living often dominate headlines as formidable foes, yet they're just elements of our financial ecosystem's natural ebb and flow. The real challenge isn't just managing these changes; it's ensuring the economy remains accessible and affordable for everyone."

This nuanced approach shifts the narrative from impending doom to manageable cycles. It reminds us that while Inflation can tighten the purse strings, it also moves in patterns that can be anticipated and planned for.

This understanding of inflation as a manageable cycle leads us directly into another core area of economic strength—the job market.

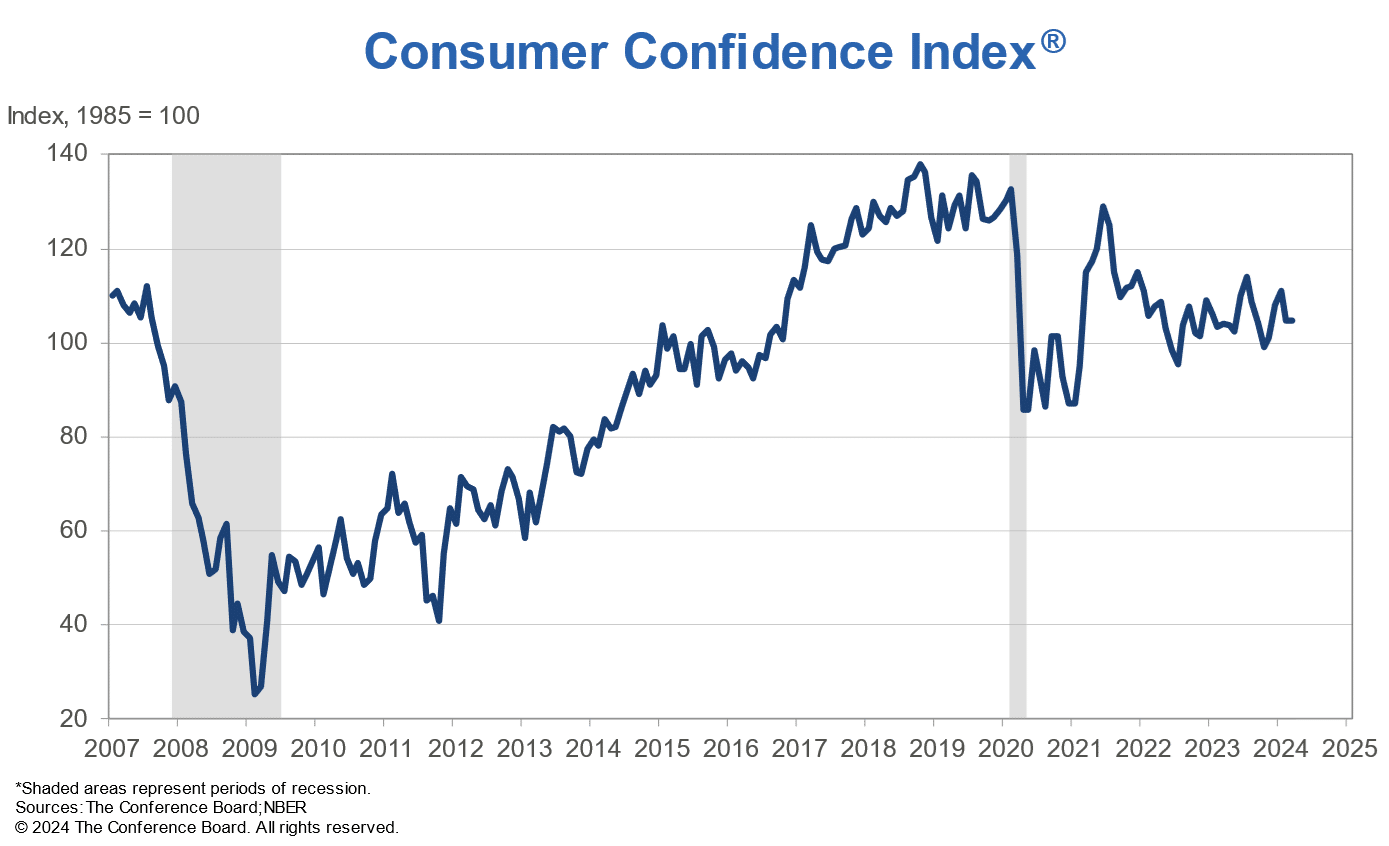

Job Market and Consumer Confidence: Pillars of Growth

Celebrating Job Market Wins

In March alone, the U.S. added a whopping 303,000 jobs. Imagine the entire city of St. Louis buzzing with new employment opportunities—that's the scale we're talking about! Even amid the fluctuations in interest rates, this robust job creation signals that businesses are not just optimistic about the future—they're investing in it. This momentum builds confidence not just in boardrooms but also in living rooms across the country.

Steady as She Goes with Unemployment

Consider this: unemployment has been comfortably lounging under 4% for over two years. This stability is nothing short of impressive in the often unpredictable economic landscape. It's a solid indicator of ongoing economic health, reinforcing consumer confidence and encouraging them to keep the wheels of our economy turning through their spending.

Spending Smart in Shaky Times

Despite a robust job market, let's not sugarcoat it—dealing with rising prices is challenging and is still a reality for many. Yet, there's a silver lining. Thanks to job stability, folks have the confidence to navigate these tricky waters by adapting their spending habits.

This isn't about clamping down and cutting out all the fun stuff; it's about making more intelligent choices. Believe it or not, this smart spending keeps the economic wheels turning.

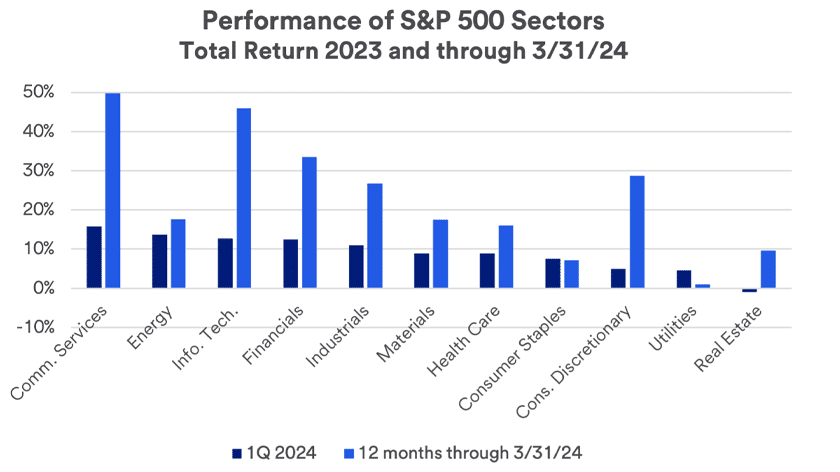

Stock Market Dynamics: Strength and Resilience

Celebrating a High-Flying Market

The S&P 500 just closed out its best first quarter since 2019, soaring to new heights. What's driving this? A lot of the boost comes from the tech and consumer sectors—areas where we spend our money daily. This isn't just good news for Wall Street; it's a sign that big and small companies are thriving, and that's a win for everyone with a stake in the market.

Why Optimism is Blooming This Spring

April tends to be the month that brings a fresh wave of market highs. Investors are not just hopeful but are actively betting on the market's continued success, drawing confidence from past springs where growth was as abundant as the season's first flowers. This widespread optimism underscores a belief that the economy will remain solid, fueling further gains.

Understanding the Ups and Downs

As thrilling as it is to watch the market climb, it's crucial to remember that the stock market is inherently cyclical. Adam Turnquist, Chief Technical Strategist, points out, 'While stocks are extended to the upside, this backdrop suggests pullbacks should be used as buying opportunities.'

This perspective doesn't lessen our enthusiasm but equips us to navigate market fluctuations more confidently. It's a reminder that while prices may dip, these moments are often seen as opportunities for those looking to invest.

As consumers adjust their budgets, let's examine how the stock market's performance reflects these broader economic behaviors.

Long-term Economic Projections and Federal Reserve's Strategy

Robust Economic Growth Unfazed by Rate Fluctuations

Economic forecasts remain bullish, predicting sustained growth across key sectors of the U.S. economy. This growth is not merely a temporary surge but is rooted in solid fundamentals that are expected to withstand fluctuations in interest rates. Such resilience underscores a vital point: the economy is robust enough to thrive even as monetary policies adjust.

Navigating Inflation with a Steady Hand

While the Federal Reserve's recent maneuvers to adjust interest rates often grab headlines, the real story for investors and businesses, in this particular economic cycle, is the surprisingly minimal impact these changes have had on the broader market's momentum.

"The Federal Reserve is focused on fighting inflation with monetary policy intended to slow consumer demand," yet, despite these efforts, the market has continued to prosper, showcasing the underlying strength of the economic engine.

Celebrating Economic Resilience and Market Success

In the face of often gloomy predictions tied to Federal Reserve rate maneuvers, the data tells a different story—one of enduring strength and optimism. The resilience across various sectors demonstrates that broader economic dynamics have a more significant impact than the often-discussed rate changes.

Embracing a Future of Prosperity

For investors and consumers alike, the real takeaway should be the stability and growth prospects that continue to characterize our economic landscape. Rather than getting sidetracked by the current discussions on when and how often the Fed will cut rates, investors and consumers would benefit more from focusing on the positive economic trends that are defining this specific period.

The outlook is promising and signals a continuing era of prosperity. This perspective invites us to look forward confidently, investing in and benefiting from an economy that consistently proves its robustness.