401 (K) & 403(B) Management

for Employees

Have You Checked Your

Account Lately

If you're like most people, you make your monthly contributions but ignore how your savings are managed. Unfortunately, ignoring your savings can silently erode its potential, leaving you to possibly face unforeseen financial hurdles later on.

Managing a 401k or 403b alone can be a daunting and time-consuming task. We understand that with life's constant demands, managing your investments can become just another burden on your never-ending "to-do list".

Are You Looking For A Solution ?

At Family Dynasty Advisors, we offer a solution that integrates seamlessly with your current plan. Our unique software enables us to actively manage your funds directly within your existing company account — no transfers needed.

The Hurdles We Understand

Too busy to

worry about it.

With all you’re juggling — work, family, personal time — when do you have a moment to consider options?

Don't know

what to do.

For many, the wide range of investment options can feel as confusing as reading a foreign language.

Don't want to

think about it.

The market’s “ups and downs” can be exhausting, potentially causing you to simply look the other way.

The Value of Professional

Portfolio Management

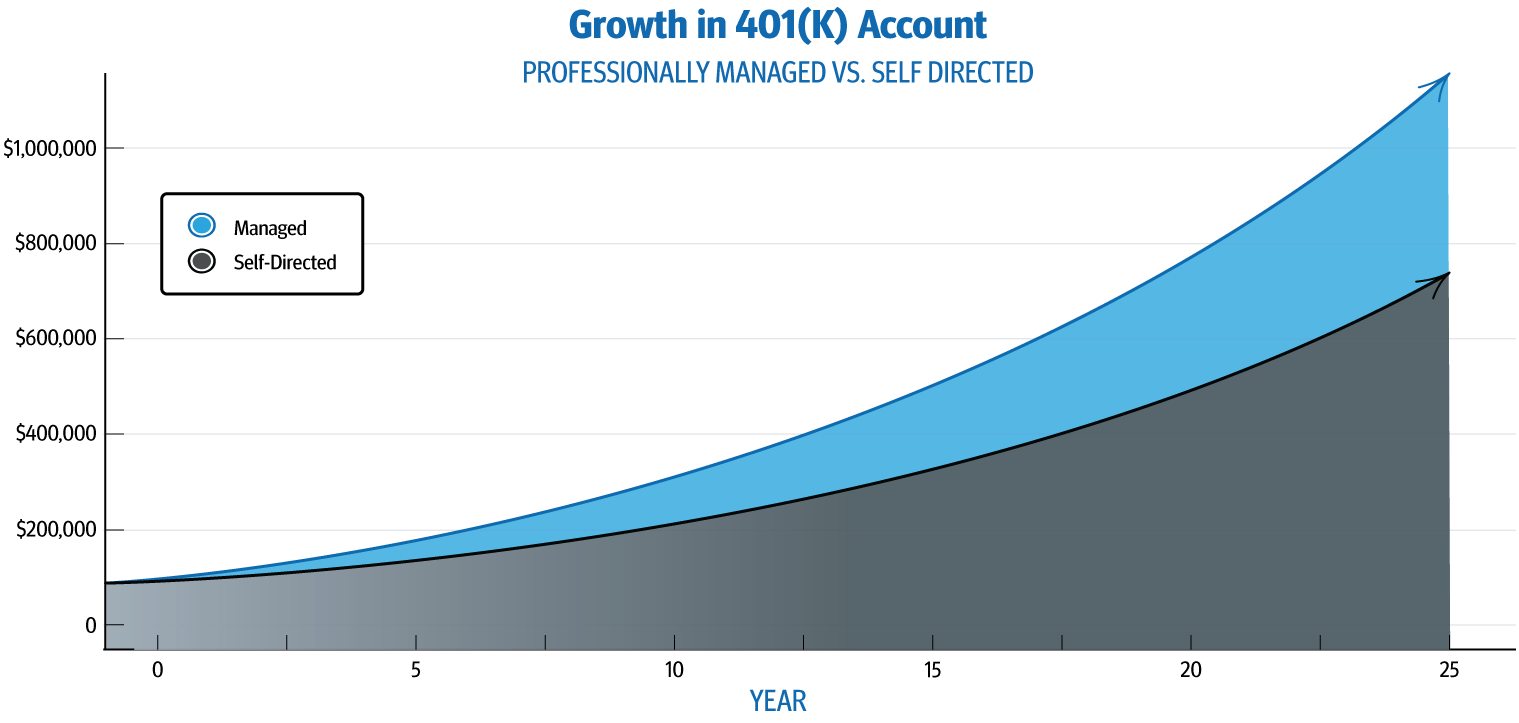

Professional management of a 401(k) / 403(b) can result in over +75% more growth over time. Vanguard’s Advisor Alpha analysis estimates financial advisors can add 3% or more in annual returns, net of fees.

The Benefits

Enhanced Asset Allocation

Proactive Risk Management

Disciplined Rebalancing

This example does not incorporate additional contributions.

Putting a value on your value: Quantifying Vanguard Advisor’s Alpha, Vanguard, 2022.

Comprehensive Support

We understand that effective financial management extends beyond investment choices. Our comprehensive support system is designed to address all facets of your financial life, ensuring you receive holistic advice and practical solutions.

- Tax-smart planning & investing

- Personalized family wealth planning

- Active rebalancing of investment portfolios

- Behavioral coaching

Tailored Support for Every Stage of Your Career

NEW HIRES

Guidance and support for setting up your 401(k) / 403(b) to balance retirement savings with your current financial plans.

EARLY CAREER EMPLOYEES

Build a robust 401(k) / 403(b) strategy that sets you up for long-term financial success from the start.

SEASONED PROFESSIONALS

Help with optimizing your 401(k) / 403(b) as you begin to cross various milestones and retirement becomes more in focus.

Retirement Solutions for Your Business

The core strength of your business hinges not just on productivity and outcomes, but on the well-being and security of your employees.

By partnering with Family Dynasty Advisors, your company elevates its approach to employee retirement planning.

We specialize in delivering personalized financial guidance for each employee’s 401(k) or 403(b) plan, ensuring that everyone on your team has the support they need to make informed decisions about their future.