US Investors Love the US Investors have put more than $86B into US equity mutual funds and ETFs this year, and on pace to be the second highest year since 2013 (last year’s record $156B). Of the $93B that was added to US or international equity funds, more than 90% has gone into ones owning US stocks. US stocks are …

Market Update

Stocks The market climbed 5.5% on Friday (maybe partly on a short squeeze). A basket of the most shorted stocks surged 11% >on Thursday. A market overrun by sellers is one that can see a lot of people change their mind very quickly (and result in gains greater than may be warranted). Since 2008, Thursday was the second biggest reversal …

How 4 Generations Think Differently About Retirement

The COVID-19 pandemic upended Americans’ lives. In many cases, the pause on society affected retirement finances and plans. An October 2022 survey report from Transamerica Center for Retirement Studies and Transamerica Institute, “Emerging From the COVID-19 Pandemic: Four Generations Prepare for Retirement,” examined the pandemic’s impact on Baby Boomers, Generation X, Millennials, and Generation Z. The study focused on the …

Market Update

Stocks A belief in peak hawkishness + prevailing pessimism of money managers (making them underweight) could keep this rally going. Fear of missing out perhaps? The market rallied, despite the widespread belief that this is a bear market rally, only making the Fed more aggressive. Highlights The decline in earnings growth for Q3 has largely been applied to growth stocks. …

IRS to Make Largest Increase Ever to 401(k) Contribution Limit

Americans can save thousands more dollars in tax-advantaged retirement plans in 2023. Millions of Americans can save more in retirement accounts next year, after inflation adjustments made Friday by the Internal Revenue Service. The employee contribution limit for 401(k) and similar workplace plans will jump $2,000 to $22,500 for 2023, the largest increase ever in terms of dollars and percentage, …

Market Update

Earnings Conventional wisdom is that when the Fed wins its fight with inflation, stocks will take off. But if inflation slows and wage inflation is sticky, margins will contract. Early in the cycle, inflation helps companies. Later on, it hurts margins. Analysts expect Q3 EPS of $55.67, up 2.6% YoY. Excluding energy companies, earnings would contract 3.9%. As economy slows, …

Andy Friedmand Says SECURE 2.0 Should Pass After Midterms

Very few bills are likely to move in the lame duck session that historically grips Congress after mid-terms, but Washington insider Andy Friedman believes SECURE 2.0 (Securing a Strong Retirement Act of 2022) has an excellent shot. “Right now, the Senate and House have each passed [their version of the] bills with only minor differences that are easily worked out. …

Market Update

Currencies The dollar rose 7.2% for the quarter – its strongest quarterly gain since 2015. It rose 3.2% in September. The dollar is being pushed higher by an aggressive Fed and the relative stability of the U.S. economy. The extreme dollar strength could lead to an unpredictable event. It’s been amazing to see the dollar rally while other central banks …

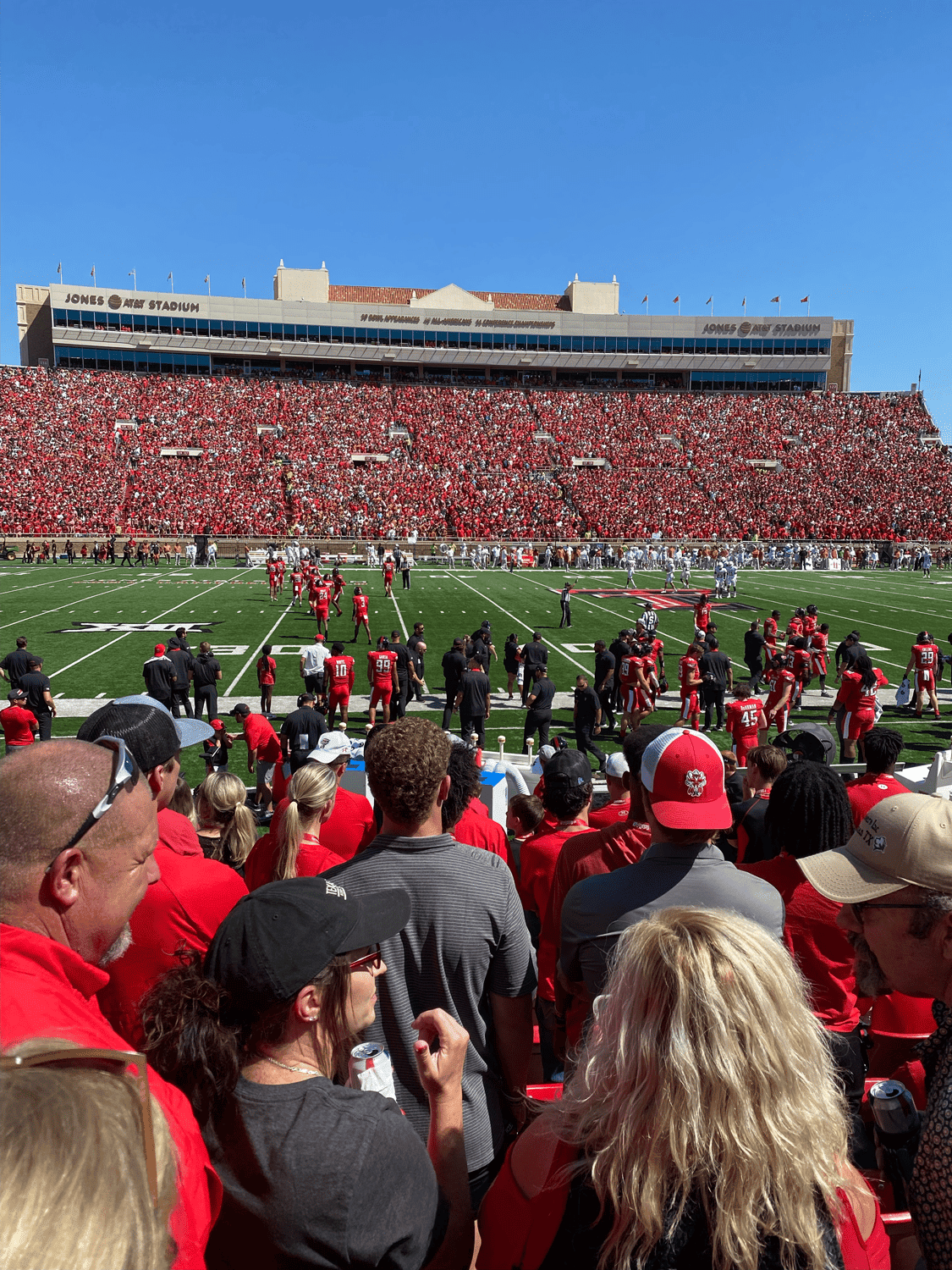

Texas vs Texas Tech

Texas Tech fans flooded the field celebrating the second straight home game after Trey Wolff drilled a 20-yard field goal for a 37-34 overtime win. We were there to catch all the action! Good food, great friends, and a stellar overtime game made for an exciting Saturday.

Market Update

Markets The stock market faces slower economic growth while central banks are trying to slow inflation, which has not subsided meaningfully. Q3 earnings growth estimates have dropped from 9.8% to 3.7% since June. Seven of 11 sectors are now expected to show YoY earnings declines. In periods of high inflation, earnings have historically peaked just two months prior to the …